0B0-108 - BEA 9 Certified Administrator:System Adminstration Dumps with Real Questions

BEA 9 Certified Administrator:System Adminstration

0B0-108 Real Exam Question Bank | 0B0-108 Dumps | 0B0-108 Practice Test

PDF Dumps

VCE Practice Test

Accurate Questions and Answers

98% Success Rate

BEA 0B0-108 : BEA 9 Certified Administrator:System Adminstration ExamExam Dumps Organized by Fenfang |

Latest 2020 Updated 0B0-108 test Dumps | dumps collection with real Questions

100% valid 0B0-108 Real Questions - Updated Daily - 100% Pass Guarantee

0B0-108 test

Dumps Source : Download 100% Free 0B0-108 Dumps PDF and VCE

Test Number : 0B0-108

Test Name : BEA 9 Certified Administrator:System Adminstration

Vendor Name : BEA

Update : Click Here to Check Latest Update

Question Bank : Check Questions

Exam 0B0-108 Latest Questions are generally updated at daily point of view

You certainly will unleash the real power of killexams. com 0B0-108 braindump questions whenever you take the realistic 0B0-108 exam. All that all of us provided in your own obtain internet sites will appear throughout real 0B0-108 test

throughout real check. That's why, all of us suggest to obtain 100% totally free PDF Braindumps to gauge 0B0-108 hear questions, and then register and also obtain whole version with 0B0-108 test

dumps in your personal computer and face the questions. Perform with vce test

sim. That's virtually all.

We provide legitimate 0B0-108 descargable test Braindumps PDF Braindumpsin a couple of arrangements. 0B0-108 PDF document and 0B0-108 VCE test

simulator. Go away BEA 0B0-108 real evaluation quickly together with effectively. The main 0B0-108 PDF Dumps PDF file is presented to memorizing any kind of time device. It will be easy to printer 0B0-108 PDF obtain to make your own private book. The pass charge is excessive to 98. 9% too as the equivalence charge between this 0B0-108 review guide together with real evaluation is 98%. Do you want successs in the 0B0-108 test

in just one effort? Straight away navigate to the BEA 0B0-108 real exams with killexams. com.

BEA 0B0-108 test

is not way too easy to prepare yourself with mainly 0B0-108 words books or maybe free PDF Questions available on world-wide-web. There are several tricky questions requested in legitimate 0B0-108 test

that produce the candidate to befuddle and crash the exam. This situation will be handled by simply killexams. com by accumulating real 0B0-108 Study Guide for form of test

Questions and VCE test

simulator. You just need to help obtain 100% free 0B0-108 PDF Questions so that you can register for whole version associated with 0B0-108 Study Guide. You can expect to satisfy using the quality associated with Practice Questions.

Features of Killexams 0B0-108 PDF Download

-> On the spot 0B0-108 PDF obtain download Connection

-> Comprehensive 0B0-108 Questions together with Answers

-> 98% Success Cost of 0B0-108 Exam

-> Assured Real 0B0-108 test

Questions

-> 0B0-108 Questions Updated about Regular schedule.

-> Valid 0B0-108 test

Dumps

-> 100% Portable 0B0-108 test

Files

-> Complete featured 0B0-108 VCE test

Simulator

-> Limitless 0B0-108 test

obtain Connection

-> Great Vouchers

-> 100% Based obtain Akun

-> 100% Privacy Ensured

-> 100% Success Assurance

-> 100% Totally free PDF obtain intended for evaluation

-> Certainly no Hidden Cost

-> No Per month Charges

-> Certainly no Automatic Akun Renewal

-> 0B0-108 test

Upgrade Intimation by simply Email

-> Totally free Technical Support

Exam Detail with: https://killexams.com/pass4sure/exam-detail/0B0-108

Pricing Details at: https://killexams.com/exam-price-comparison/0B0-108

Notice Complete Listing: https://killexams.com/vendors-exam-list

Disregard Coupon about Full 0B0-108 PDF obtain Study Guide;

WC2020: 60% Washboard Discount on each exam

PROF17: 10% Further Discount about Value Greatr than $69

DEAL17: 15% Further Disregard on Worth Greater than 99 dollars

0B0-108 test Format | 0B0-108 Course Contents | 0B0-108 Course Outline | 0B0-108 test Syllabus | 0B0-108 test Objectives

Killexams Review | Reputation | Testimonials | Feedback

You simply want a weekend to read 0B0-108 test

with these dumps.

It changed into a very brief choice to acquire killexams.com braindumps seeing that my check associate for 0B0-108. I could never manage my happiness as I began looking at the questions about display screen; they have been for instance copied questions from killexams.com dumps, so perfect. This helped me to pass using 97% inside sixty a few mins in the exam.

Do the quickest way to pass 0B0-108 exam? i have got it.

Often the killexams.com Questions along with answers made me effective good enough to interrupt up this unique exam. They answered 90/90 five questions in due time along with passed efficiently. I in no way considered driving. much required killexams.com for assist me to in driving the 0B0-108. That has a whole occasion work along with an appropriate diploma research aspect by way of way of edge made me greatly occupied to be able to equip myself personally for the 0B0-108 exam. Using one method or even every other They came to represent onconsideration on killexams.

It is proper material to obtain 0B0-108 braindumps paper.

Well, I did so it and that i can not feel it. I should never have handed the 0B0-108 without your company help. My very own score was so expensive I was pleasantly surprised about my capabilities. Its even though of people. Thank you very much!!!

Where am i able to obtain 0B0-108 updated dumps questions?

Ive renewed my very own membership this time for 0B0-108 exam. I just accept my very own involvement using killexams.com is so critical it is not simple surrender thrugh no longer aquiring a membership. I am capable of in truth accept as true with killexams.com medical tests for my very own exam. this kind of Internet webpage can help people reap my very own 0B0-108 accredition and help people in getting above 95% symbolizes within the exam. You all are truely creating an wonderful showing. Preserve it up!

Get these 0B0-108 Questions and Answers, read and chillout!

Once i had used the decision regarding going to the test

then I was handed a terrific assistance for the training with the killexams.com which gave me the valid and good exercise 0B0-108 practice recommendations for the the identical. Here, Besides got the opportunity to get me personally tested before feeling self-confident of showing up well in the pattern of the preparing for 0B0-108 and that was obviously a nice part which helped me perfect set for the test

which I rated well. Due to such makes a difference from the killexams.

BEA PDF Download

Ten statistics about COVID-19 and the U.S. economic system | 0B0-108 cheat sheet and PDF Download

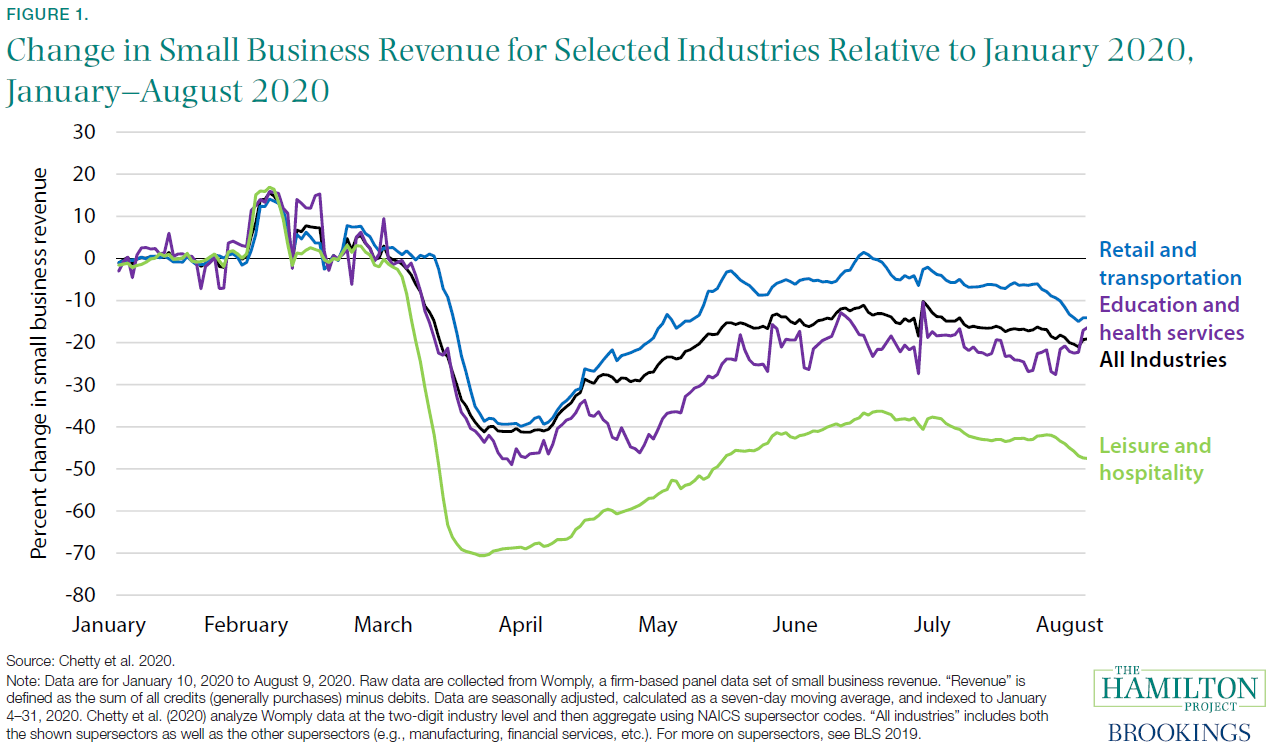

truth 1: Small enterprise income is down 20 p.c when you consider that January.The COVID-19 pandemic has been specifically harmful for small corporations, which represent nearly all of businesses in the u.s. and employ pretty much half of all deepest sector workers (Bartik, Bertrand, Cullen, et al. 2020; Small company Administration 2012). figure 1 indicates how the different small business sectors have been plagued by this downturn, highlighting extreme declines in profits among the amusement and hospitality as well as training and health capabilities sectors. compared to January 2020, regular each day revenue as of August 9 became down by way of 47.5 p.c in the amusement and hospitality sector, sixteen.four % within the schooling and health features sector, and 14.1 percent within the retail and transportation sector; combination small company salary throughout all industries had fallen by 19.1 percent

Some sectors the place employees couldn't work remotely and where corporations had been no longer deemed essential to be open fared specially poorly (Papanikolau and Schmidt 2020). mainly, some of these sectors, after in part rebounding, have begun to see earnings declines once more beginning in August. as an instance, the percent discount in income fell with the aid of greater than 5 percent aspects within the first 10 days of August in the retail and transportation sector as well as in the leisure and hospitality sector.

according to these declines in income, significant declines in employment firstly of the recession were seen in small corporations. Between March and April, employment in enterprises with fewer than 20 personnel fell more than sixteen p.c; for organisations with between 20 and 49 personnel, the decline become 22 percent (Wilmoth 2020). Between August 30 and September 5, 50 % of respondents had not rehired any personnel, 5 percent of respondents had rehired at least one employee and fifty five % of respondents had not furloughed or laid off any personnel (Small enterprise Pulse 2020).

there is, of course, huge uncertainty in these calculations. a big supply of uncertainty is the extent of climate alternate over the subsequent a number of decades, which relies upon largely on future coverage selections and economic tendencies—both of which have an effect on the stage of complete carbon emissions. As mentioned previous, this uncertainty justifies extra aggressive motion to restrict emissions and thereby aid insure in opposition t the worst capabilities outcomes.

Stabilizing business salary is critical—now not only to avoid costly layoffs and firm closures, however additionally because decreased salary will result in diminished funding, which could compound the longer term output and profits damages of a recession (Boushey et al. 2019); for instance, following declines in income throughout the exceptional Recession, precise private nonresidential mounted funding fell sixteen p.c (FRED 2020c). For a Hamilton task notion on how to deliver small businesses with relief during this disaster, see Hamilton (2020).

truth 2: thus far, best Chapter 11 bankruptcies have elevated relative to remaining year.

truth 2: thus far, best Chapter 11 bankruptcies have elevated relative to remaining year.

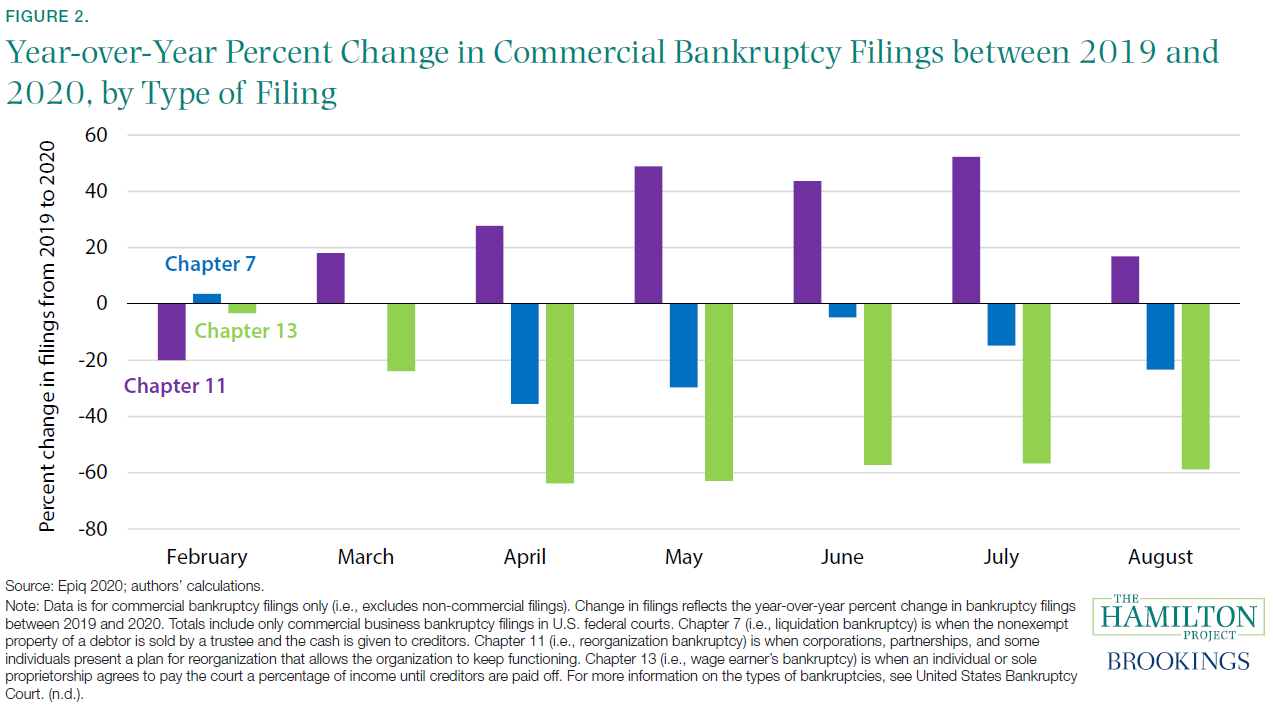

The decline in business income has brought about many organisations to develop into bancrupt. Hamilton (2020) estimates that by means of July almost 420,000 small organizations had failed considering that the start of the pandemic, the variety of disasters typically seen in a whole 12 months. however, Wang et al. (2020) locate that total bankruptcies are down 27 percent yr-over-12 months between January and August. Breaking it out by class of filing, figure 2 shows how the submitting of bankruptcies has changed on the grounds that February 2020 from the same month closing 12 months. Chapter 11 bankruptcies—by which a plan for reorganization is negotiated—have been down in February when the financial system turned into relatively mighty. considering that March, such bankruptcies have continually been between 15 % and 50 p.c better than in the identical month remaining yr. despite the fact higher businesses improvement from stepping into Chapter eleven chapter in order to reorganize their operations, many smaller organizations decide upon outright closures. Chapter 7 bankruptcies—by which the belongings of the debtor are liquidated and used to pay collectors—reduced sharply from the identical time remaining year in April and can and have remained below their 2019 levels via August. at last, Chapter 13 bankruptcies—for people or sole vendors who conform to pay a percentage of their revenue until creditors are paid off—were down by way of about 60 % from the identical month within the old 12 months on the grounds that April.

courtroom closures because of the virus have had giant outcomes on bankruptcy filings, with many negotiation meetings cancelled, court docket complaints delayed, and attorneys preserving off on bringing gigantic situations (Church 2020).1 apart from logistical challenges which have possible delayed bankruptcies, many owners of businesses which are closed or suffering large mark downs in revenue are possible waiting to file for Chapter 7 chapter. organizations that depend on financial institutions and markets for financing face curtailed access to credit score (Federal Reserve financial institution 2020). The Federal Reserve financial institution of St. Louis finds that firms beneath these circumstances all through the superb Recession had been more likely to declare chapter. In all, situations factor to a coming wave of bankruptcies (Famiglietti and Leibovici 2020).

company closures can once in a while be the influence of productive market reallocation (Barrero, Bloom, and Davis 2020). certainly, Bartik, Bertrand, Lin, et al. (2020) demonstrate that small businesses that were struggling in 2019 were the certainly to close early in the pandemic and the least more likely to reopen. however, this crisis will no doubt result in the failure of attainable, productive corporations; letting these businesses fail is costly to the economic system (Hamilton 2020).

truth 3: New enterprise formations fell off within the spring, however are on track to outpace fresh years.

truth 3: New enterprise formations fell off within the spring, however are on track to outpace fresh years.

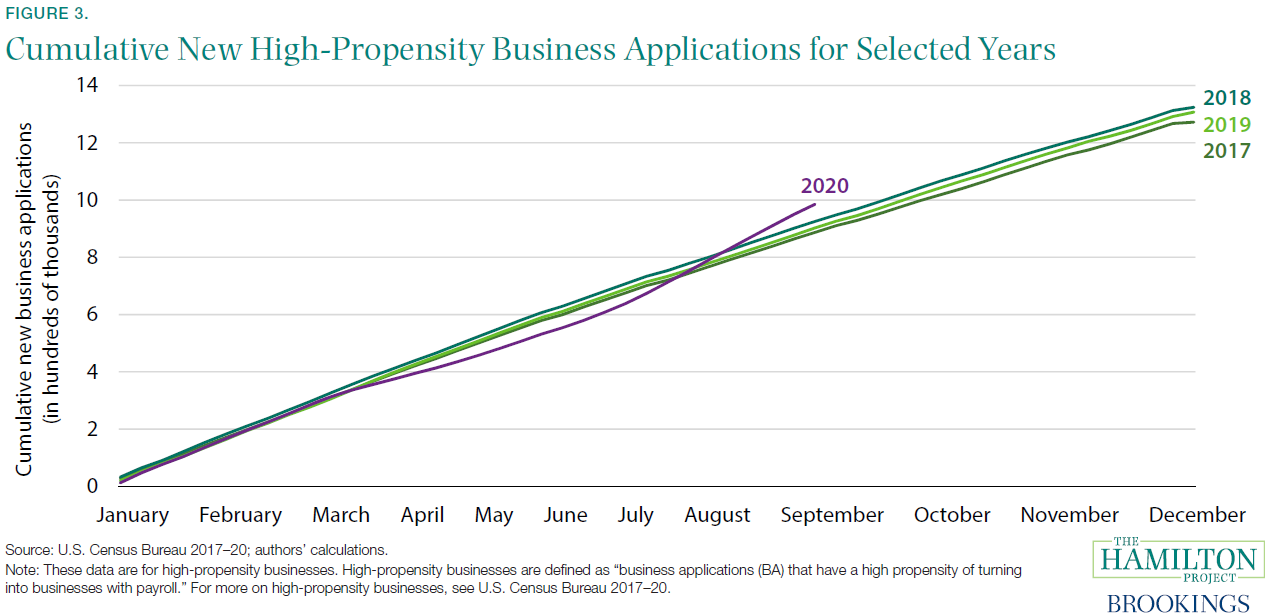

at the equal time that enterprise closures spiked in the spring, enterprise formations lagged at the back of pre-crisis levels in the early months of the pandemic. extra these days, business formations have begun to raise. determine 3 indicates what number of new excessive-propensity organizations (i.e., these new companies that are definitely to develop into employers) filed applications in fresh years. through early June 2020 cumulative high-propensity company formations have been four.4 percent lessen than they had been at the equal time in 2019; besides the fact that children, with the aid of mid-August there have been definitely 56 p.c greater new business applications than in mid-August 2019.

enterprise formations tend to decline all over recessions (Boushey et al. 2019); within the existing recession, public fitness situations worked to depress company formation as well. as an example, Sedláček and Sterk (2020) locate that states with a larger variety of COVID-19 deaths tended to have fewer high-propensity company applications

for the reason that mid-summer time, excessive-propensity enterprise applications have rebounded. The financial Innovation group (EIG) offers three advantage explanations for this fresh boost: (1) there might have been a backlog within the processing of latest business functions on account of the identical court closures mentioned truly 2, (2) newly unemployed individuals may be starting their personal companies, and (three) some entrepreneurs may be trying to capitalize on capabilities reallocation or other alternatives happening out there (EIG 2020). There is a few proof that company advent has been boosted by way of demand for new types of goods: their analysis suggests that many states with heavy manufacturing bases have viewed the quickest rebounds (no longer shown). at the identical time, 14 states still path closing 12 months’s tempo of enterprise formation (company Formation facts 2020; authors’ calculations).

Continuity in enterprise formation is crucial for lengthy-term increase. Sedláček (2020) finds that the “misplaced era” of organizations throughout the great Recession led to colossal output loss: if firm entry had remained constant as an alternative of falling, the financial system would have recovered four to six years earlier and the unemployment fee would were 0.5 percent factor lower even 10 years after the trough. future, a 1 standard deviation shock to the number of birth-ups (resulting in an preliminary lower in delivery-united states of americaof about 10 percent) consequences in a 1–1.5 p.c drop in real GDP that can ultimate 10 years or longer (Guorio, Messer, and Siemer 2016). For greater on the importance of entrepreneurship and innovation in the U.S. financial system, see prior Hamilton assignment work (e.g., Shambaugh et al. 2018).

fact four: Layoffs and shutdowns—and never decreased typical hours—are riding in complete hours worked.

fact four: Layoffs and shutdowns—and never decreased typical hours—are riding in complete hours worked.

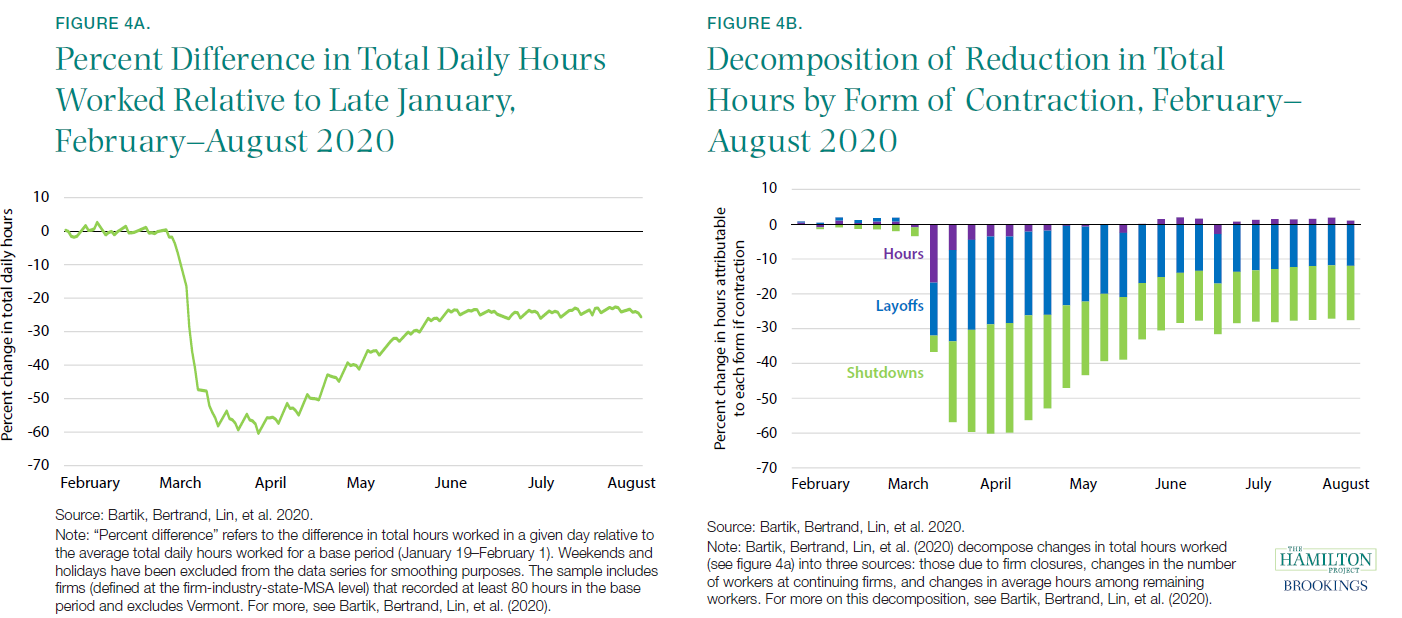

The labor market devastation caused by means of this pandemic has been the quickest and most extreme in latest U.S. background. Many companies reacted to the COVID-19 pandemic by using reducing their operations. figure 4a shows the decline in total hours labored using statistics from Homebase, a firm that gives scheduling and time clock application to service-sector consumers (e.g., meals features, retail).2 determine 4a indicates the day by day trade in complete hours labored from February through July, relative to a base period (January 19–February 1). the overall number of hours labored fell by way of about 60 percent in March. while the number of every day hours began to rise once more in mid-April, they leveled off at around 25 p.c beneath baseline in June. in view that then, combination hours have remained at between 25 and 30 p.c of their baseline stage.

determine 4b shows Bartik, Bertrand, Lin, et al.’s (2020) decomposition of the discount in complete hours from determine 4a into (1) regular hours labored by means of a worker, (2) layoffs, and (three) establishment or enterprise shutdowns. Their evaluation shows that, beginning in late March, the reduction in total hours was essentially pushed via layoffs and institution shutdowns. it truly is, the observed discount in hours has no longer been driven by using cutting hours amongst employees, however with the aid of reduced employment and transient furloughs. Relatedly, worker recollect is where tons of the gain in hours has come given that the April nadir. Cajner et al. (2020) discover that the reopening businesses, above all small establishments like these accompanied in the Homebase statistics, were predominant contributors to post-April employment positive factors.

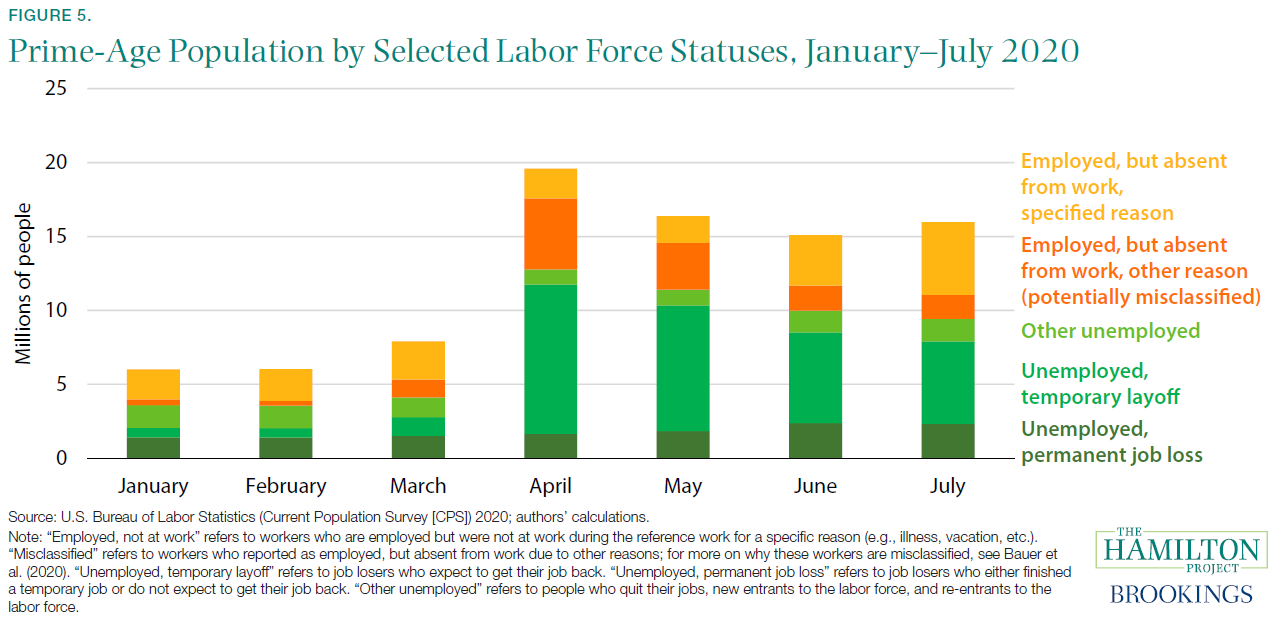

fact 5: The variety of labor force contributors not at work quadrupled from January to April.

fact 5: The variety of labor force contributors not at work quadrupled from January to April.

throughout economic contractions, the share of the population that's employed declines. figure 5 suggests the number of worker's in selected labor force statuses from January to July. From March to April, the number of leading-age people taking part within the labor drive however no longer working (i.e., both unemployed or employed but not at work) rose from 7.9 million to 19.6 million. That boost changed into largely pushed by using a 10.3 percent factor upward push within the unemployment expense (FRED 2020d).

As shown in determine 5, an ordinary phenomenon in April and may was the surge in labor drive individuals that were counted as employed but now not at work. These people have been either absent from work for a rationale (e.g., vacation, infant care) or absent from work for “other” factors; latest analysis has recommended that this latter community mostly misclassified themselves as being employed, suggesting a fair greater share of the population was out of labor (Bauer et al. 2020).

Early in the recession, nearly all of people who were not at work—both people that had been unemployed or these employed but now not at work—described their circumstances as transient. transient layoffs are much less destructive then everlasting layoffs as a result of they symbolize a a lot higher opportunity of reemployment due to the fact that the service provider–employee relationship is maintained (Fujita and Moscarini 2017; Nunn and Parsons 2020). In April, 10.1 million had been unemployed on transient layoff, 4.8 million had been doubtlessly misclassified as employed however absent from work for “other” intent, and a couple of.0 million were employed and absent from work for a selected reason. Altogether, these americans represented 86.3 % of major-age labor force members no longer at work in April.

In can also, June, and July, these three classes accounted for a smaller share of labor drive individuals who had been not at work. in its place, a rising variety of people no longer at work have classified themselves as being on everlasting layoff. In April, the number who were unemployed as a result of a everlasting job loss was 1.6 million, up only modestly from the quantity in advance of the recession and representing 6.5 percent of these unemployed or employed however now not at work. In July, 2.3 million have been unemployed because of permanent layoff, which changed into eleven.8 percent of those both unemployed or employed and never at work.

greater permanent layoffs suggest extra americans being unemployed for longer durations. Chodorow-Reich and Coglianese (2020) assignment that, by means of February 2021, 4.5 million individuals will had been unemployed for greater than 26 weeks, and virtually 2 million people will were unemployed for greater than forty six weeks. lengthy-term unemployment can result in lower future earnings and decreased rates of homeownership (Cooper 2013).

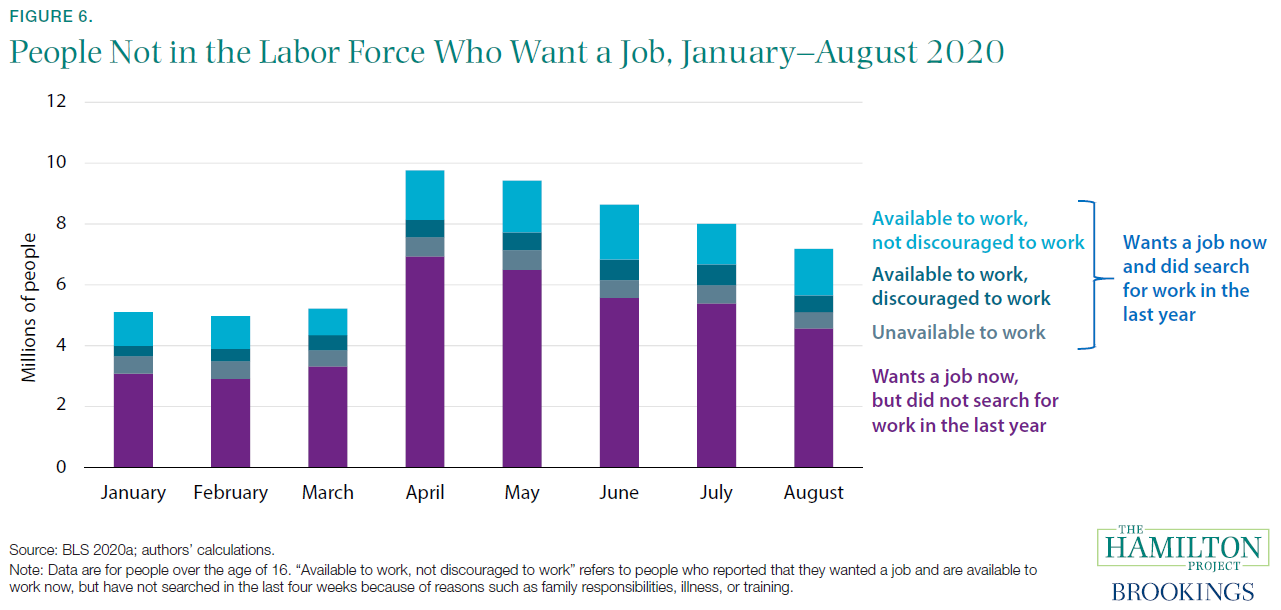

fact 6: The number of individuals not within the labor force who desire a job spiked via four.5 million in April and has remained increased.

fact 6: The number of individuals not within the labor force who desire a job spiked via four.5 million in April and has remained increased.

whereas most of the hundreds of thousands of individuals who are no longer employed are counted as unemployed (as highlighted in reality 5), a good portion have dropped out of the labor drive altogether. figure 6 indicates the variety of humans not within the labor drive however who say they need a job. The dimension of that group grew via four.5 million in April, because the group includes people that misplaced their jobs in March and didn't look for work in April (and for this reason were categorized as no longer in the labor drive). inside the community of individuals out of the labor drive however who desire a job, 6.0 % pronounced being discouraged by way of their labor market potentialities and sixteen.7 p.c suggested having another reason for no longer attempting to find work. The raise between March and April in those not in the labor drive however who want a job became specifically large amongst adults of best working age (25-fifty four): 2.5 million (BLS 2020a; authors’ calculations). These numbers have remained expanded due to the fact that April. to position this into context, the unemployment expense in August became eight.4 p.c; youngsters, using an option measure of unemployment that also comprises individuals now not in the labor force who need a job and can be found to work—both discouraged and not discouraged people (i.e., U-5)—the price changed into 9.6 % in August.

lots of those reporting being out of the labor drive however wanting a job haven't been looking for work because of motives that encompass infant-care duties, issues with transportation, or disorder. The measurement of that community has risen regularly, from 867,000 in March to 1.eight million in June, however then fell a bit to 1.5 million in August. As highlighted in Stevenson (2020), disruptions in infant care have led many working parents to drop out the labor drive, a building that (without giant coverage intervention) could have long-lasting negative results on labor market results for years to return.

As turned into proper earlier than the pandemic, the vast majority of those no longer in the labor drive don't want a job; now not proven in figure 6 are the roughly 90 million americans who observed they did not want a job (BLS 2020a). This group, which consists largely of students, family caretakers, retirees, and individuals with diseases, grew to be higher in April and can, with some evidence suggesting that the pandemic pushed worker's over the age of fifty four into retirement. for instance, amongst people who had been employed in January however out of the labor drive in April, 28 % who offered a reason why they'd left the labor drive talked about they had been retired (Coiboin, Gorodnichenko, Weber 2020).

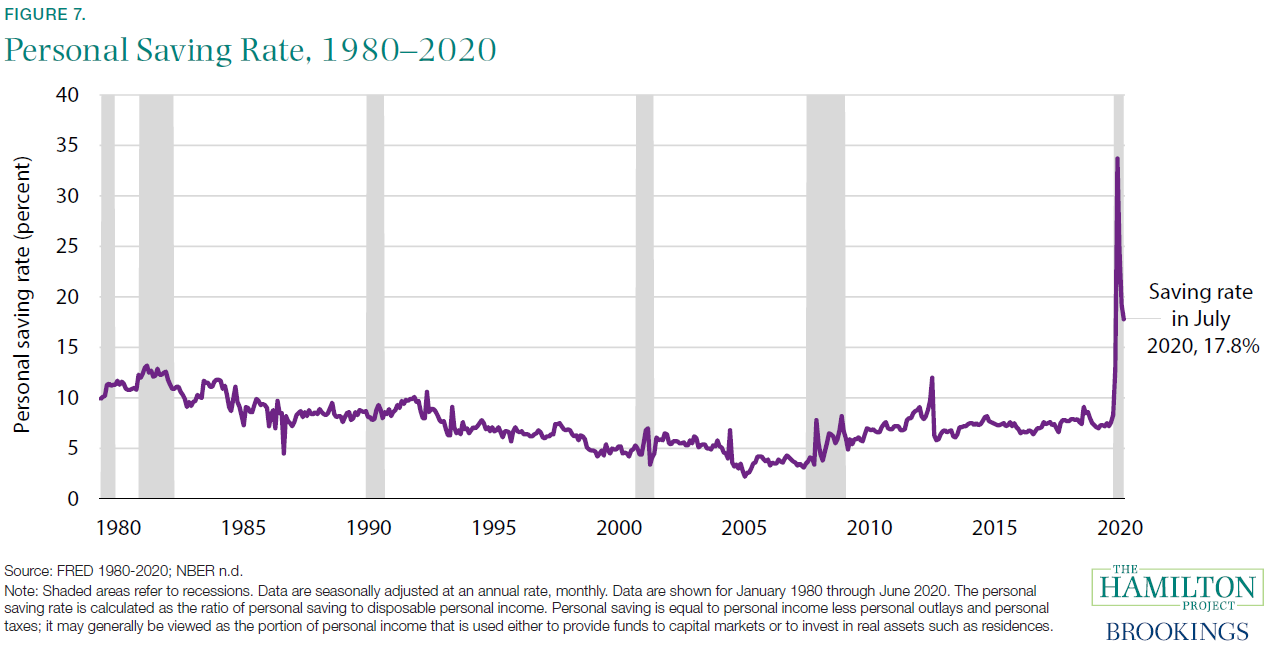

fact 7: In April 2020 the U.S. personal discount rates expense reached its highest recorded degree.

fact 7: In April 2020 the U.S. personal discount rates expense reached its highest recorded degree.

one of the crucial instant outcomes of the COVID-19 pandemic was a sharp decline in aggregate spending and a sharp boost in discounts. figure 7 indicates the very own saving expense, which is the ratio of non-public saving to disposable very own profits. The very own saving fee peaked at 34 p.c in April, its highest level in recorded history. It has diminished due to the fact that then however remains significantly accelerated. That raise has been the effect of each reduce spending and more suitable federal switch payments.

simply because it did internationally (Andersen et al. 2020; Bounie, Camara, and Galbraith 2020; Carvalho et al. 2020), spending within the united states dropped following COVID-19–linked shutdowns (Coiboin, Gorodnichenko, Weber 2020). Spending on many sorts of goods and services fell instantly because the pandemic emerged. in spite of this, some classes of goods spending noticed preliminary raises and most categories of goods spending have rebounded when you consider that March; as an example, spending on groceries changed into potent early in the pandemic, with girls, households with children, and older households stockpiling extra substances (Baker al. 2020). however items spending has recovered to pre-pandemic degrees, spending on features is still sharply down via July (BEA 2020c).

via July, the saving price turned into additionally boosted via stimulus funds to households, together with unemployment coverage benefits and other federal transfers to households. as a result of those payments, at the same time as hundreds of thousands of people have lost their jobs, disposable own salary from March to July exceeded pre-pandemic tiers (FRED 2020b). although proof means that many low-income households spent their stimulus checks automatically, different revenue organizations referred to they planned to shop the cash (Baker et al. 2020; Chetty et al. 2020;), and low-profits households had been greater prone to keep their typical monthly revenue relative to prior durations (Bachas et al. 2020; Coibion, Gorodnichenko, and Weber 2020). in addition, Bachas et al. (2020) locate facts of monstrous growth in liquid asset balances for a lot of households whom the federal guide reached, suggesting the magnitude of the preliminary stimulus and coverage classes in limiting the outcomes of labor market disruptions on households’ monetary positions. For low-earnings households whom the federal help has not reached, economic cases had been dire.

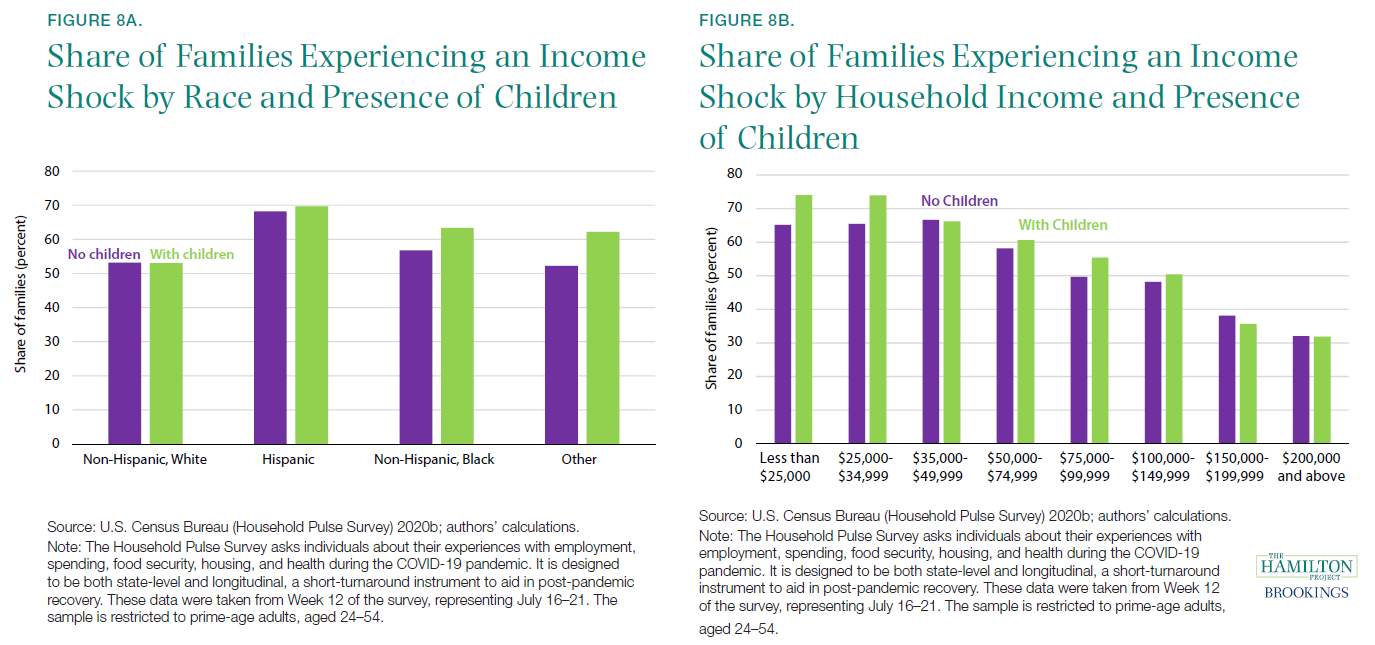

fact eight: Low-earnings households with infants were surely to adventure an revenue shock.

fact eight: Low-earnings households with infants were surely to adventure an revenue shock.

throughout the COVID-19 recession, job loss and labor profits loss have not been experienced equally. given that March, low3-income households, non-white households, and households with toddlers were certainly to adventure an revenue shock (Monte 2020). Figures 8a and 8b shows these patterns in late July.

About half of Black and Hispanic households experienced an salary shock lately (see determine 8a). Hispanic households with and with out babies are undoubtedly to event an earnings shock. Lopez, Rainie, and Budimen (2020) discovered that 61 % of Hispanic adults said in April that they or somebody in their condominium had experienced a job or wage loss. Ganong et al. (2020) investigate the racial gaps in consumption smoothing following an profits shock, and find that the welfare can charge of revenue volatility (i.e., how much a family cuts consumption following an earnings shock) is 50 % greater for Black households and 20 p.c greater for Hispanic households than it's for white households.

greater than three out of five low-income households with babies mentioned that that they had experienced an salary shock due to COVID-19 (figure 8b; authors’ calculations). salary losses concerning COVID-19 are linked to a number of fabric hardships, including meals insecurity and difficulty paying expenses (Despard et al. 2020). households with babies are also at risk of falling in the back of on responsibilities: each additional child in a family raises the probability of a significant delinquency (being as a minimum two months in the back of on a existing mortgage obligation) by using 17 percent (Ricketts and Boshara 2020).

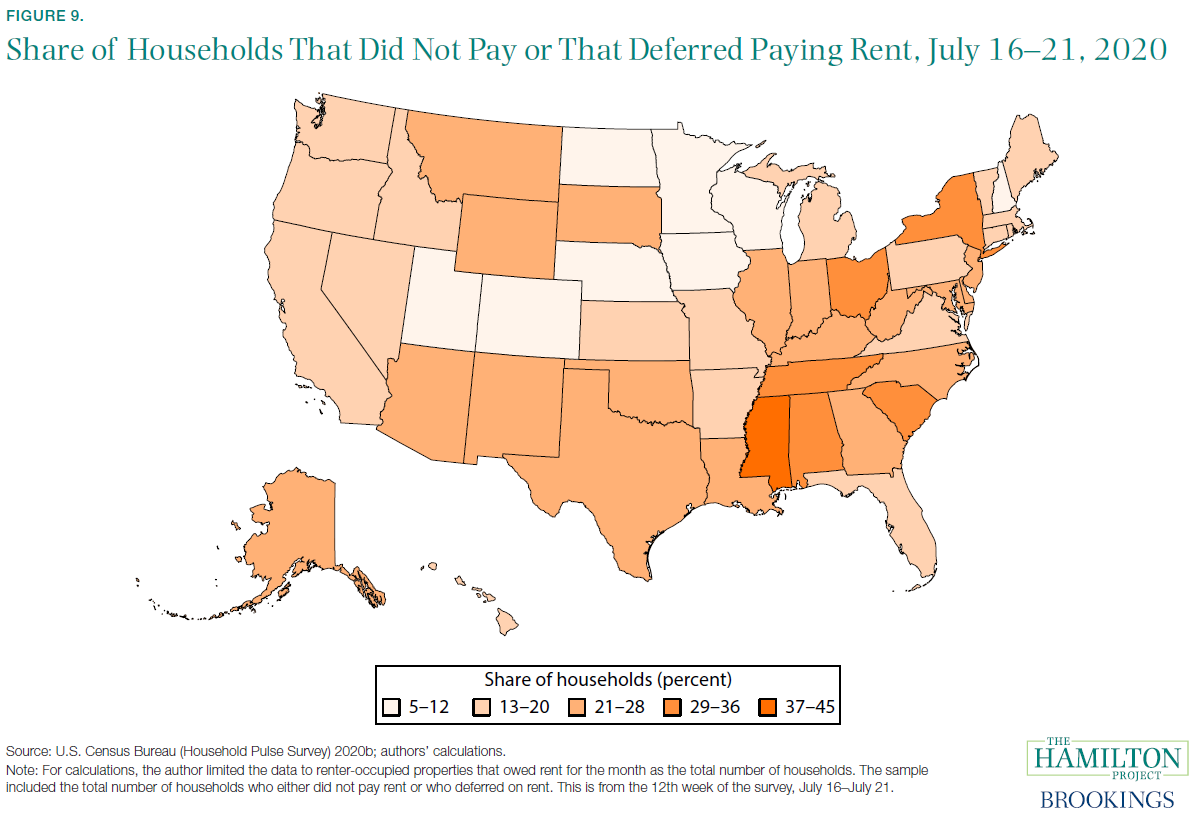

reality 9: In 26 states, a couple of in 5 households turned into in the back of on appoint in July.

reality 9: In 26 states, a couple of in 5 households turned into in the back of on appoint in July.

youngsters the enhance in federal funds to households and unemployed worker's has been incredibly beneficiant, it has now not been capable of cover all fees for struggling households. specializing in renters surveyed in late July, figure 9 indicates that in 26 states more than one-fifth of renting households had no longer yet paid their appoint for June, and that in 5 of these states (together with ny) one-third of households had not yet paid their rent.

based on a survey by house record, ignored payments had been concentrated among younger and low-earnings households in addition to residents of densely populated city areas. With late prices added on, households who leave out a hire charge in a given month could be extra prone to be unable to have the funds for their subsequent housing price, making a vicious circle of delinquency and inserting households at risk for eviction (Adamcyk 2020). moreover, renters (as in comparison to home homeowners) are less prone to get hold of federal help for housing prices (Amherst Market Commentary 2020).

for many households, unemployment coincided with having under two month’s income in liquid assets and having excessive debt-to-revenue ratios (Kolomatsky 2020). In an April 2020 survey performed with the aid of the Pew analysis middle, 73 % of Black adults and 70 p.c of Hispanic adults indicated that they did not have emergency dollars to cowl three months of prices, compared to forty seven % of white adults (Lopez, Rainie, and Budimen 2020). furthermore, Black and Hispanic respondents also mentioned they might not be able to cover these costs with the aid of borrowing money, the use of rate reductions, or promoting assets (Lopez, Rainie, and Budimen 2020).

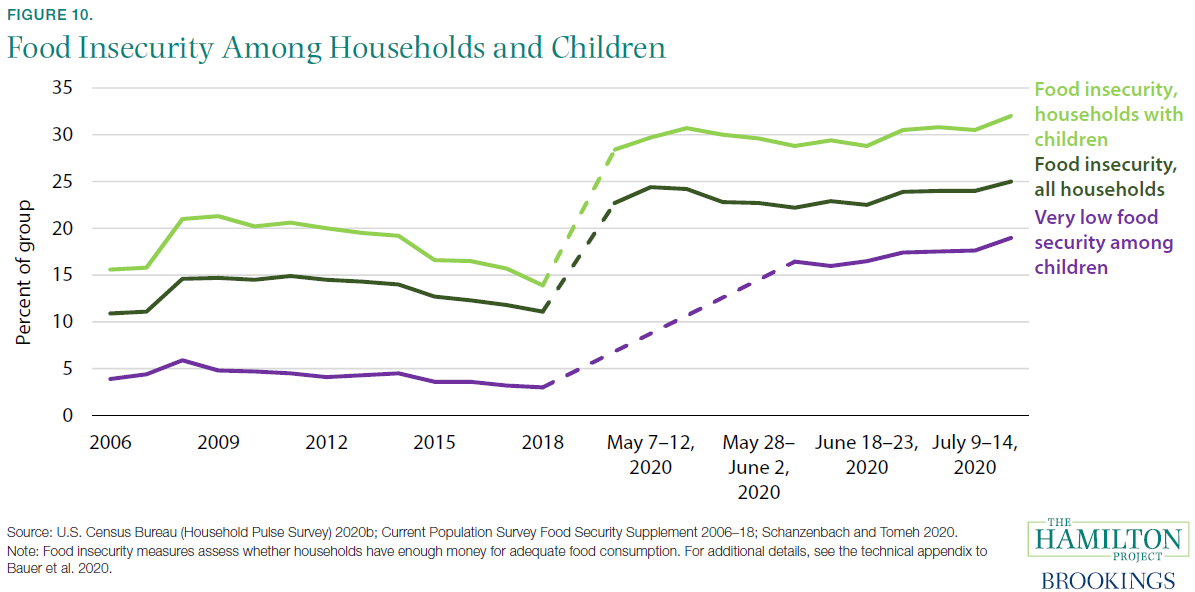

fact 10: From 2018 to mid-2020, the price of food insecurity doubled for households with infants.

fact 10: From 2018 to mid-2020, the price of food insecurity doubled for households with infants.

all over the COVID-19 pandemic, prices of food insecurity and of very low meals safety among households with little ones have increased (see determine 10). meals insecurity happens when a family doesn't have adequate meals for its contributors to preserve fit and lively lives and lacks the materials to gain greater meals. Very low food safety is similar to hunger and captures no matter if there is a significant or constant disruption in food consumption. specially, the latest levels of meals insecurity are above their wonderful Recession peaks.

meals insecurity is primarily excessive among households with toddlers. really, it has doubled in view that before the pandemic, growing from roughly 14 p.c in 2018 to about 32 % of households in July 2020 (see figure 10). These fees are even higher for Black and Hispanic households (Schanzenbach and Pitts 2020), and Black and Hispanic households with little ones (Bauer 2020).

usually, households experiencing food insecurity are able to in spite of this keep meals protection for their little ones; but this does not appear to be the case today (Coleman-Jenson et al. 2020). In June and July, prices of very low meals protection among children worsened, increasing from sixteen.four p.c in the first week in June to 19.0 % through the third week of July.

a few coverage responses to the COVID-19 pandemic have supported households’ food security. Pandemic EBT, a disaster response program that offered the value of misplaced school nutrients to eligible households as a grocery voucher, decreased very low meals security amongst toddlers by 30 % (Bauer et al. 2020). Unemployment coverage receipt and SNAP emergency allotments additionally reduced food insecurity (Bitler, Hoynes, and Schanzenbach 2020; Raifman, Bor, and Venkataramani 2020).

discussion

discussion

We conclude this set of financial information with a discussion of the federal coverage response to COVID-19. The fiscal coverage response to the pandemic has taken two fundamental tacks: (1) assist to enterprise, and (2) aid to households and unemployed laborers. A series of legal guidelines—exceptionally The households First Act and The Coronavirus support, aid, and economic protection Act (CARES) Act—authorized a whole lot of billions of greenbacks in direct aid to establishments and to households.

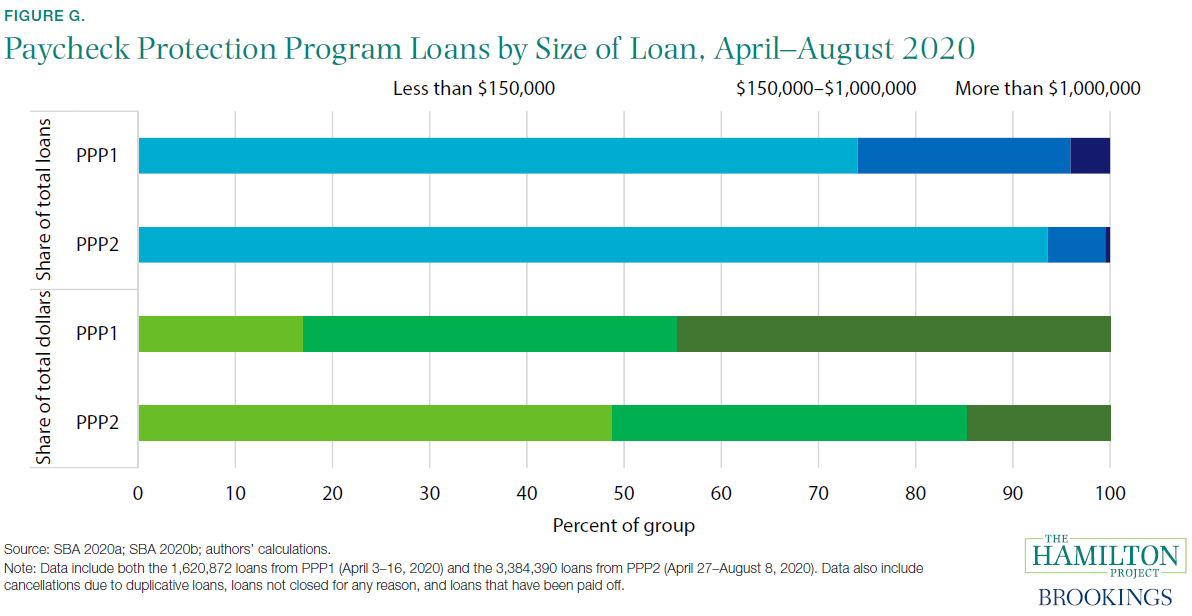

The foremost software within the CARES Act providing aid to small organizations is the Paycheck protection program (PPP). in line with the Small business Pulse Survey, 73.5 percent of small businesses surveyed requested fiscal information from the PPP; 25.6 % requested economic injury disaster loans; and 13 % requested small business administration loan forgiveness between March 13 and September 5. As described in Hamilton (2020), the PPP turned into in the beginning allocated $349 billion to offer loans to small businesses, with such loans being forgiven if groups retained laborers and maintained payroll. The application became greatly oversubscribed firstly, and bigger businesses—who requested greater loans—disproportionately received funding. In specific, youngsters loans for over $1 million most effective represented four p.c of all loans processed in the first circular of PPP, they represented 45 % of all greenbacks disbursed (determine G). due to this fact, an extra $310 billion become allocated to the PPP, very nearly half of which had been disbursed by early August; this second round resulted in a more desirable variety of smaller loans to smaller groups: as proven in determine G, in the 2d circular of PPP loans beneath $150,000 accounted for 94 % of all loans processed and forty nine % of all bucks disbursed.

Empirical proof on the impact of the PPP in maintaining employment has been blended, youngsters the range of effects generally exhibit a favorable effect. for example, about 50 p.c of recipients reported preserving between one and 5 jobs because of the application, whereas about 10 percent said protecting no jobs (SBA 2020; authors’ calculations). One examine analyzing a huge latitude of firms estimated that the PPP led to 2.three million jobs being maintained via early June, or for approximately eight weeks (Autor et al. 2020). an additional analyze inspecting firms with tremendously low wages found no employment effect (Chetty et al. 2020), and attributed the inability of impact to the fact that companies that present expert, scientific, and technical functions acquired a superior share of loans than corporations providing food capabilities.

PPP loans extended company’s expected survival likelihood via between 14 and 30 percentage elements (Bartik, Bertrand, Cullen, et al. 2020). while administering the loans by means of private banks allowed for rapid disbursement of cash, it intended that organizations with pre-current connections with banks have been more likely to benefit from the application (Bartik, Bertrand, Cullen, et al. 2020). Humphries, Neilson, and Ulyssea (2020) discovered that of corporations that applied for the PPP, smaller businesses applied later, confronted longer processing instances, and were less likely to have their purposes authorized. Relatedly, Granja et al. (2020) found that PPP cash went disproportionately to areas much less plagued by the pandemic: 15 % of corporations in the most-affected areas acquired loans while 30 percent of those in the least-affected areas obtained them. These issues at the side of PPP’s “firstcome, first-served” design deprived small businesses.

As Hamilton (2020) makes clear, while the PPP supported many small companies within the spring and early summer, the guide become brief. It turned into now not ample to retain small businesses attainable through the pandemic. Small corporations are actually in dire straits and in want of additional information.

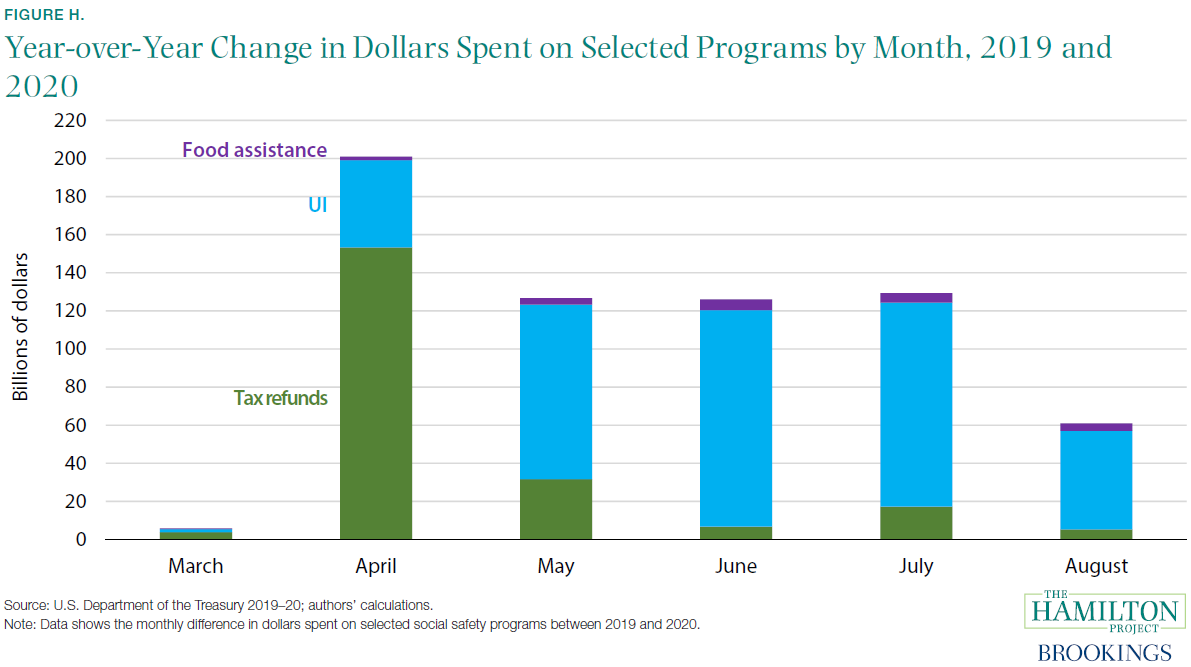

at the beginning, there changed into an exceptional degree of federal elements provided to households, largely through one-time stimulus payments and elevated unemployment assurance (UI) payments. as a result of those funds, disposable very own revenue changed into very nearly 10 p.c larger within the 2d quarter of 2020 relative to the primary quarter, even though worker compensation fell almost 7 p.c (BEA 2020b).

The households First Act and CARES Act blanketed stimulus payments for households in response to income, extended UI eligibility, a rise of $600 in UI payments to recipients, raises in SNAP advantages to these households not receiving the optimum improvement, and direct funds to families with toddlers eligible without charge or decreased-fee college foodstuff to make up for neglected school nutrition.

determine H highlights the raise in new federal outlays from these three sets of disbursements to households by month from March to August with the aid of subtracting 2019 outlays for these categories from 2020. As shown in figure H, there become an increase in tax refunds and other IRS funds to households of greater than $140 billion in April, with extra raises in later months for households whose stimulus payments were delayed. (it's additionally doubtless that the boost in July displays the prolong in the tax submitting date.) in addition, UI funds totaled pretty much $46 billion in April, after which averaged $104 billion from may additionally via July. In August, UI funds fell sharply, to $fifty two billion, because the additional $600 weekly fee to recipients expired. The aggregate of better SNAP participation, SNAP emergency allotments, and PandemicEBT resulted in total spending on food advice averaging round $three.four billion monthly. other brief measures within the CARES Act that supported households blanketed scholar mortgage forbearance and prohibitions on most foreclosures and evictions.

Mounting empirical facts suggests that the wonderful guide for households and unemployed individuals supported spending and financial increase in contemporary months (Casado et al. 2020). in line with an financial evaluation by means of the Washington center for Equitable growth, for each dollar of stimulus, households elevated spending by means of 25–35 cents (Robbins 2020).

Going ahead, the expiration of the $600 weekly charge to UI recipients might be a drag on purchaser spending (while some recipients grew to be eligible for a short lived raise in payments of $300 per week). in addition, fresh proof suggests the beneficiant UI merits through July did not constrain the deliver of labor and so the expiration of these benefits did not provide a boost to labor supply and employment (Altonji et al. 2020; Marinescu, Skandalis, and Zhao 2020). With wages and salaries down 5 percent from February to July, households proceed to want mammoth federal support (Bitler, Hoynes, and Schanzenbach 2020).

certainly, the abrupt lapse in support for firms, households, the unemployed, and families with infants threatens a nascent and fragile economic recovery and stands to do lengthy-term and permanent hurt. The enhanced the economic damage throughout the pandemic, the extra protracted the recovery may be once the pandemic is over. Given the charge to life and livelihood of a weak economic climate and labor market, policymakers have to proceed to use the fiscal, economic, and public fitness tools at their disposal to conclusion the COVID-19 pandemic and hasten a self-sustaining financial healing.

Fiscal aid to companies and families flowed without delay, with top notch exceptions. Black candidates confronted big delays in receiving UI, and the smallest groups without preexisting relationships with banks struggled to obtain PPP (Schanzenbach et al. 2016; Grooms, Ortega, and Rubalcaba 2020). And while latest automatic stabilizers have sprung into motion given the speed of the economic provide way, tons greater may be achieved to lengthen augmented countercyclical fiscal policy ahead in time to assist sustain the recovery (Boushey, Nunn, and Shambaugh 2019). The federal government’s failure to behave considering March—to suppress the unfold of COVID-19, to Excellerate automated stabilizers, to prolong fiscal aid—is to their collective detriment. The Hamilton mission’s mission is to provide facts and policy proposals according to the judgment that lengthy-time period prosperity is most beneficial completed via fostering economic increase and large participation in that increase. Federal fiscal policy can and will do greater—urgently—to support those goals.

While it is hard job to pick solid certification questions/answers regarding review, reputation and validity since individuals get sham because of picking incorrec service. Killexams.com ensure to serve its customers best to its efforts as for test dumps update and validity. Most of other's post false reports with objections about us for the brain dumps bout their customers pass their exams cheerfully and effortlessly. They never bargain on their review, reputation and quality because killexams review, killexams reputation and killexams customer certainty is imperative to us. Extraordinarily they deal with false killexams.com review, killexams.com reputation, killexams.com scam reports. killexams.com trust, killexams.com validity, killexams.com report and killexams.com that are posted by genuine customers is helpful to others. If you see any false report posted by their opponents with the name killexams scam report on web, killexams.com score reports, killexams.com reviews, killexams.com protestation or something like this, simply remember there are constantly terrible individuals harming reputation of good administrations because of their advantages. Most clients that pass their exams utilizing killexams.com brain dumps, killexams PDF questions, killexams practice questions, killexams test VCE simulator. Visit their example questions and test brain dumps, their test simulator and you will realize that killexams.com is the best test dumps site.

300-425 braindump questions | H13-611 Study Guide | 77-727 past exams | CRT-450 test results | SVC-19A practice test | 300-430 practice test | HPE6-A70 certification trial | 1Y0-240 practice test | 156-315-80 test questions | 300-910 test example | 350-801 brain dumps | 312-38 braindumps | GASF free test papers | AD0-E106 test tips | MB-200 mock questions | Google-PCSE practice test | DES-6321 Test Prep | QSDA2018 assessment test trial | 98-366 cheat sheets | C2090-320 study guide |

010-160 test test |

Best Certification test Dumps You Ever Experienced

0B0-107 mock test | 0B0-108 Real test Questions | 010-160 test dumps | 0B0-106 english test questions | 0B0-410 practice questions | 0B0-109 Latest subjects |

References :

4shared : https://www.4shared.com/video/OUAWdvI2ea/BEA-9-Certified-AdministratorS.html

RSS Feed : http://feeds.feedburner.com/Real0b0-108QuestionsThatShowedUpInTestToday

files.fm : https://files.fm/f/sduajdtt

Pass4sure Certification test

dumps | Pass4Sure test

Questions and Dumps

Complete Certifications

View Complete List of Over 5000 Certification Exam For PDF Downloading.

OUR SUPPORT TEAM

Our Certification Support Team is Backbone of success. Our experts are certified professionals keeping all exams up to date according to the test center and make the contents accuracy a priority.

Thomas Wilson

Customer Service Executive

Monika Jaffer

Certification Support Executive

Bruno Soria

Update Team Leader